Deep dive into the pharma/biotech industry, part 1

Basic, intermediate, and advanced nuances within the industry with a focus on gene therapy

Let me start with the disclaimer that this is the part of the healthcare value chain that is probably the most interesting, the hardest to understand, and from an investing perspective, both one of the most attractive and the least attractive. What I mean by the last point is that the spread of outcomes is widest within healthcare for pharmaceutical and biotech companies because of the large increase/decrease of economic outcome that can result from a drug approval/rejection.

The Basics – the good and bad of pharma/biotech

The basic model of pharma/biotech is straightforward – they either develop drugs in-house or acquire/license them externally or combination of these two strategies, conduct or coordinate clinical trials on these drugs to ensure they are safe and effective, and then if they are approved by regulatory bodies, then the companies have access to a monopoly of ~10yrs during which they are responsible for manufacturing and marketing the drug. Depending on the company, most or none of these activities can be outsourced, eg., you can acquire products from smaller companies that develop them, you can outsource research efforts and clinical trials to CROs (contract research organization), you can outsource manufacturing to CDMOs (contract development and manufacturing org), and outsource marketing to CCOs (contract commercialization org). As a rule of thumb, smaller companies focus on research and outsource most other activities while larger companies focus on commercialization and outsource the other activities.

One point of clarification from above is that the typical patent life in the US is 20 yrs so why do I say that the monopoly of a given drug only lasts for 10 yrs? It’s because it takes ~10yrs to develop a drug from scratch so the clock starts ticking once you start investigating a given drug candidate for a given disease. The other figures to drive home just how complicated the process of drug development is are cost of $2bn to develop a drug from start to finish and the probability of FDA approval (the US regulatory body that approves/rejects drug applications) for a preclinical drug is just 1/5000 or 0.02%! So that’s the bad.

What’s the offset or the good? As I said the companies have a monopoly status over these drug products once they are approved and can price the drugs as per their monopoly status. In addition, you have pricing power over the remaining patent lifetime of the drug as well to an extent. Pricing is clearly something that attracts regulatory scrutiny so companies have realized that they can only pull so far on this particular lever. The FDA, however, is more lenient towards companies that design drugs for diseases that have few viable treatments. The most recent example of this was seen with the approval of Biogen’s Alzheimer’s drug, Aduhelm, which was approved despite inconclusive empirical evidence perhaps with the hope that this would attract more capital and more viable treatments for Alzheimer’s.

Moving on intermediate-level nuances

Not all therapeutic areas are created equally. Some areas like oncology attract a lot of capital but arguably, allow have a lot of demand to warrant the capital. Other areas, like Alzheimer’s, which was mentioned above, have little capital (up to now) chasing it but a lot of demand which makes for a more attractive opportunity potentially. There are additional regulatory incentives for working on therapeutic areas with high demand and little/no supply of viable treatments like an accelerated approval schedule. This is essentially how we were able to approve a vaccine for covid-19 within ~1yr.

Additionally, the time to development is not necessarily as long as 10yrs for all types of therapeutics. For eg., it has taken about three decades to commercialize the first genetic treatment known as Luxterna for a genetic disorder that causes blindness in 2017. Gene therapy went through several stumbling blocks like an unexpected death from a clinical trial done in the late 90s that killed supply of additional capital towards this potential therapeutic area. But, use of a different vector for delivering the treatment (adeno-associated virus or AAV versus adenoviruses that previously led to fatalities) led to the successful approval of a viable gene therapy. With a template now in place for developing and approving gene therapies, it should make it easier for subsequent gene therapies to be developed and to gain approval. Unlike other drugs, the mechanism behind gene therapies doesn’t need to be researched as typically the gene therapy fixes a single gene abnormality that causes the disease. It is no surprise then that companies are now creating platforms upon which they can rapidly scale the development of new therapies based on a single vector.

Platforms for therapies are not a novel idea and the last version of this was platforms by biotech companies like Genentech (now under Roche) and Regeneron to make antibody-based drugs. An oversimplification of antibodies are drugs that can selectively nuke specific targets. Antibody platforms automate the task of generating effective antibodies quickly. So why haven’t these companies solved all diseases and aren’t the most valuable companies in the world? Because finding an effective antibody in a test tube doesn’t guarantee its success in clinical trials involving complex systems (ie., humans). But can gene therapy platforms be different?

Boss-level nuances on gene therapy

Let’s look at the prevailing gene therapy platforms first. The platforms essentially differ based on the vector used to deliver the gene. What does that mean? Typically, synthetic genes need a way to integrate and proliferate within our bodies. Viruses are an excellent vector because of how contagious they are allowing them to spread rapidly from cell to cell. There are different categories of viruses though like adenoviruses as described above that led to a fatality in early clinical trials of gene therapy. The main virus categories that are vectors for gene therapies are highlighted below, and as the astute reader will observe, there is no category winner across all attributes.

Overall, adenovirus is the best at getting into cells and has the highest capacity for synthetic genes that you want to introduce to a given target; however, it has the worst safety profile. Adeno-associated viruses or AAVs have the best safety profile but the lowest capacity for synthetic genes so depending on the complexity of what you’re biologically programming for, it may or may not be an effective vector. Lentivirus may be an effective compromise between adenovirus and AAVs as they have a higher capacity for synthetic genes but still a relatively good safety profile.

The viral vectors discussed above encode synthetic DNA into the target, but there are also RNA-based mechanisms of gene therapy including antisense RNA and mRNA. RNA, as you may remember from highschool biology is an intermediary between DNA and proteins, the functional units of biology. RNA is also involved in other functions including regulating DNA, RNA, and proteins and as such, RNA therapeutics can be targeted towards a wider array of applications. However, the drawbacks of RNA therapeutics are also manyfold: 1) RNA is quickly degraded by proteins that target synthetic RNA; 2) getting into cells is both necessary and difficult; and 3) synthetic RNA can cause a strong immune reaction that may lead to cell toxicity. But, as shown by the mRNA vaccines for covid-19, it is possible to overcome these challenges and make a gene therapy that is safer and more effective than a viral vector DNA vaccine like those by J&J and Astrazeneca.

I’ll note that there is a difference between the two main types of RNA therapies, antisense and mRNA. In a nutshell, antisense RNA therapy blocks the conversion of a specific target RNA into protein whereas mRNA therapy supplies the specific precursor that will then be converted into a target protein of interest. Hence, while antisense silences RNA, mRNA therapy inserts synthetic RNA into the body.

Inserting synthetic DNA and RNA sequences are just one type of gene therapy and the other notable type is gene editing using mechanisms like CRISPR-Cas9 (yes, it’s a mouthful but I did warn you that this is the boss level). Gene editing, as the name implies, is going into our biological code and using a molecular scissors to edit the code, which can include cutting out code or repairing sequences or just inserting new code. This is very different from the other techniques we’ve discussed so far that mainly attempt to insert gene sequences into our biological code that will lead to downstream protein expression to fix a given disorder or to immunize someone against a virus. Gene editing sounds much more versatile than the other types of gene therapies that we’ve discussed so far, so why even bother with those? The recurring theme of our discussion is that in biological intervention there’s always a catch. And the catch with CRISPR-Cas9 are 1) concerns with lack of specificity in targeting a given genetic sequence that may lead to accidental genetic edits that are then permanent; and 2) immune response to Cas9. Note too that in contrast to other types of gene therapies, there are currently no FDA approved therapeutics based on gene editing mechanisms.

How many FDA-approved gene therapies are there?

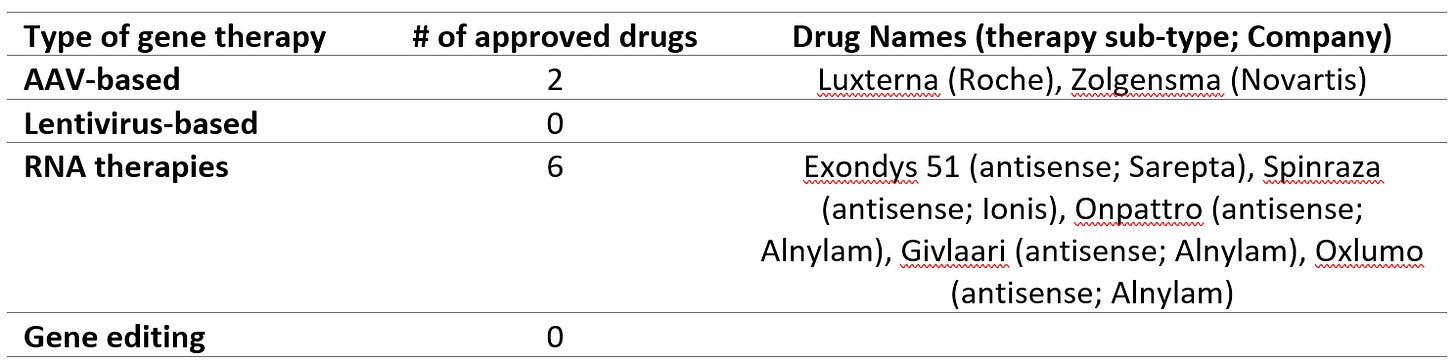

There are only a handful of gene therapies approved by the FDA to date as shown below and most of these are RNA therapies. Note that the table excludes mRNA vaccines for covid-19 that have just been approved on an emergency use basis. Even excluding these, RNA therapies are the predominant category of FDA approved gene therapies to date.

What now?

Hopefully, the summary you’ve gotten to so far is that gene therapy holds a lot of promise but there’s also plenty of uncertainty about which gene therapy platform(s) will succeed and how many iterations it will take to work out the kinks. The future reality may be that several or all of these gene platforms succeed as each has unique strengths and weaknesses that may make them optimal for different applications. Please subscribe to join me as I look at specific investment ideas within the pharmaceutical and biotech landscape.